salt tax deduction news

December 12 2021 930 AM 4 min read. Many Democrats from high-tax states.

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Under these regimes the PTE is permitted to deduct its state and local income taxes as a tax on the business at the federal level followed.

. In 2017 the Republicans pushed. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

PTE taxes As discussed states moved rapidly in 2021 to adopt pass-through entity PTE tax regimes as a workaround to the controversial federal 10000 SALT deduction limitation adopted under the TCJA. 12There has been a lot of discussion amongst government leaders about the cap on state and local. August 9 2021 1133 AM 3 min read.

Since 2018 taxpayers living in high-tax states have been unable to take an itemized deduction of state and local taxes over a limitation known as the SALT cap of 10000 per year. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely for the wealthy opposed by most Republicans and some Democrats. Learn More At AARP.

A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard.

Are you paying an arm and a leg in state and local tax SALT payments. But the Tax Cuts and Jobs Act limited that deduction to 10000. Paying a state income tax of 10 percent or more.

The Supporting Americans with Lower Taxes SALT Act sponsored by US. Erin Cleavenger The Dominion Post Morgantown WVa. 52 rows Like the standard deduction the SALT deduction lowers your adjusted.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or. That was bad news for top earners in blue states such as California and New York.

The fiscal 2022 Senate Democratic budget proposal released on Monday calls for SALT. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Republicans had limited the previously unlimited deduction to 10000 in their 2017 tax reform on the. In other words you. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

House Democrats are proposing to raise the annual SALT deduction cap to 72500 through 2031. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Tom WilliamsCQ-Roll Call Inc via Getty Images More On. The deal which was included in President Bidens. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed. Prior to the Tax Cuts and Jobs Act TCJA you could deduct the full amount with no restrictions. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

The SALT deduction let individual taxpayers who itemize their personal deductions to deduct their aggregated state and local taxes on their annual tax return. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing.

Note that the SALT deduction is available for only for a combination of state and local property taxes and either state and local income taxes or state and local sales taxes.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

This Bill Could Give You A 60 000 Tax Deduction

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Salt Analysis Finds Little Middle Class Help In Congress S Plans

The Likely End Of The Salt Tax Deduction Litigation

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

2022 Changes To Popular Tax Deductions Cpa Practice Advisor

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

The Impact Of Eliminating The State And Local Tax Deduction Report

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

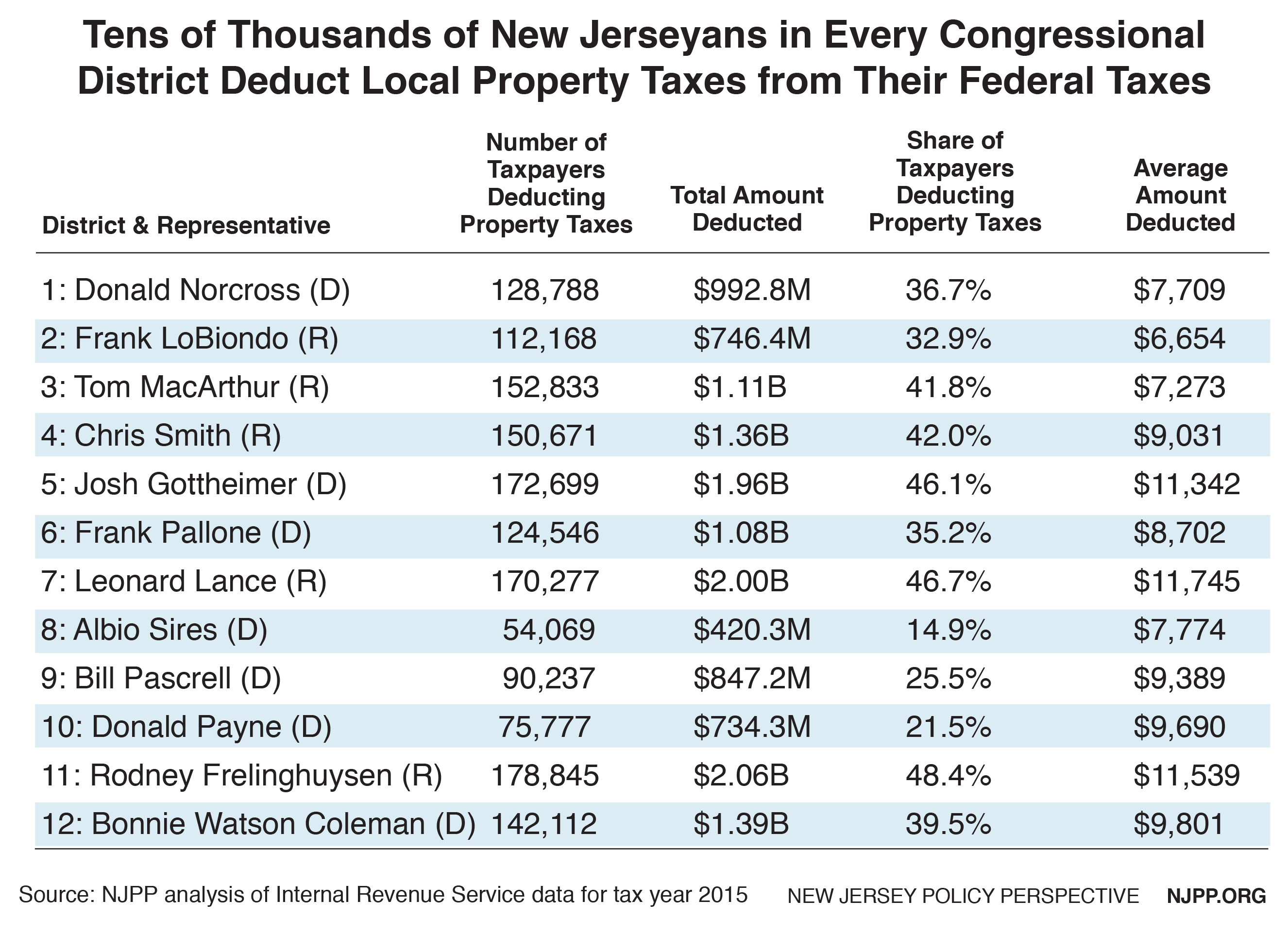

State And Local Tax Deductions Benefit Tens Of Thousands Of New Jerseyans Of All Incomes In Every Congressional District New Jersey Policy Perspective

What Is Salt Tax Deduction Mansion Global

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)